Although ESG investing is increasingly visible in institutional investing, it has made much less headway in the world of small or solo advisory practices working with high net worth individuals. It isn’t simply a matter of educating advisors that there is value in sustainability and in considering environmental, social and governance factors in investing. There’s a perception heard in conversations with advisors that their clients aren’t interested, that whatever their clients’ views are on larger societal issues, they certainly aren’t relevant to the advisor’s job of creating and sustaining wealth.

That view may be very wrong and advisors may be missing opportunities as a result. Scorpio Partnership, a UK wealth management consultancy in the UK and Kaiser Partner, a wealth management group and private bank in Europe, interviewed 250 high net worth individuals and compared their views on the drivers of societal change and their relevance to investing with those of financial advisors and experts. The differences were striking.

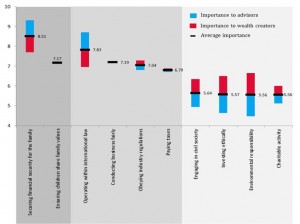

It wasn’t that the high net worth individuals didn’t believe that securing their financial security was important – it was, to both them and their advisors. The difference was that the advisors significantly underestimated the importance their clients attached to concerns such as investing ethically and environmental responsibility and at the same time perceived a much larger gap than their clients did between those issues and “core” financial concerns like paying taxes, obeying the law and ensuring their children share their family’s values.

It wasn’t that the high net worth individuals didn’t believe that securing their financial security was important – it was, to both them and their advisors. The difference was that the advisors significantly underestimated the importance their clients attached to concerns such as investing ethically and environmental responsibility and at the same time perceived a much larger gap than their clients did between those issues and “core” financial concerns like paying taxes, obeying the law and ensuring their children share their family’s values.

On a scale of 1 to 10, with 10 being the most important, advisors ranked “securing financial security” at 9.5, several of the the other “core” financial concerns around 7 and issues like engaging in civil society, investing ethically, environmental responsibility and charitable activity below 5. For the high net worth individuals, financial security ranked highest, but only at 7.5, close to the other “core” financial issues at around 7 and the societal issues around 6 – 6.5. The first attached chart from the study shows that disparity clearly.

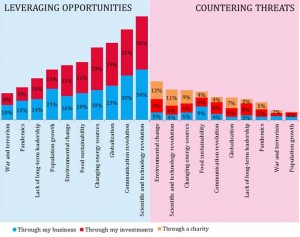

But there’s more to the study than this perception gap between high net worth individuals and advisors. The study makes clear that significant numbers of high net worth individuals see opportunities in addressing major societal challenges. Consider the substantial percentage of high net worth individuals leveraging opportunities through their businesses or their investments in these areas:

- Globalization – 52%

- Changing energy sources – 49%

- Food sustainability – 39%

- Environmental change – 37%

How companies are positioned for and responding to these same challenges is at the heart of ESG analysis and sustainability investing. High net worth individuals are making very personal and significant decisions about where to invest their money to address these challenges. If their financial advisors are not up to speed and taking advantage of ESG analysis and information, they are missing an opportunity to assist their clients.

How companies are positioned for and responding to these same challenges is at the heart of ESG analysis and sustainability investing. High net worth individuals are making very personal and significant decisions about where to invest their money to address these challenges. If their financial advisors are not up to speed and taking advantage of ESG analysis and information, they are missing an opportunity to assist their clients.

Financial advisors should also consider whether the perception gap this study demonstrates is another missed opportunity to create a deeper and more trusted connection with their clients.

More information on the study is available from the Scorpio Partnership or Kaiser Partner web sites. When I first examined them, the graphics accompanying the summaries on the web site seemed to have been mangled en route to publication, and did not accurately reflect the points made in the text. The versions I have included are from the original study and are much clearer. They were thoughtfully provided to me in an exchange of e-mails by Catherine Tillotson at the Scorpio Partnership. The version on both web sites has now been updated as well. I appreciate Catherine’ responsiveness, as the information from this study deserves a wide audience.