I want to thank Luther Ragin, CEO of the Global Impact Investing Network; Matt Patsky, CEO of Trillium Asset Management; Kyle Johnson, Managing Director at Cambridge Associates and Daniel Fireside, Capital Coordinator for Equal Exchange for their participation at our Impact Investing panel last week.

Luther, Matt, Kyle and Daniel led an informative, engaging and spirited conversation with each other and the audience. Even though I worked with them to plan the topics and flow for the panel, I can’t possibly capture the richness of the discussion in a short article. Instead, I’ll highlight several points I took away from the conversation.

Begin with our working definition:

Impact investments are investments made into companies, organizations, and funds with the intention of generating measurable social and environmental impacts while also earning a financial return.

Impact investing is sizable, growing and surprisingly diverse.

- $8 billion of impact investments was reported by 100 institutions in a 2012 survey.

- Those institutions planned $9 billion in 2013.

- Investments are being made globally, in developing and developed markets – they are as likely to support housing in under-served areas of the US as microfinance in sub-Saharan Africa.

- Virtually all asset classes are represented – public-traded equities, private equity, corporate and sovereign debt, cash, venture/early stage capital, IPOs, DPO (direct public offerings) and others.

- This is not “disguised charity” – though financial return targets vary, 2/3 of institutions report market rate of return targets.

Investor intention is the foundational element in impact investing.

- Investor intent distinguishes impact investing from an investment that happens to also have social or environmental impact.

- The investor’s impact goal will be value driven.

- The investor’s financial return goal should reflect financial and portfolio considerations but may be influenced by values.

- For investors to reach their overall financial goals, portfolio construction must take into account the specific impact investments chosen.

The measurement of impact gives impact investment robustness and rigor.

- Defining “impact” and how to measure it is hard work, but essential.

- Measuring desired outcomes requires a higher level of transparency and accountability from the target organization. That benefits financial analysis and reporting as well.

- Having agreed-upon impact measures better aligns the goals of investors and recipient organizations.

Impact investing is not just another name for SRI, ESG, responsible investing or sustainable investing.

- Impact investing’s roots are in Socially Responsible Investing, which began as a passive strategy (avoid investing in bad things). Impact investing is by definition active investing.

- There is significant commonality, crossover and confusion among these terms. For the purposes of understanding impact investing, don’t equate them.

- These other terms encompass approaches and tools that are useful in choosing and evaluating impact investments.

All investments have impact – the importance of a total portfolio view.

- The businesses and governments that deploy invested capital have impacts – positive and negative – on the impact goals of investors.

- For most investors, even the most committed ones, impact investments will only represent a fraction of their portfolio. Investors must consider whether the rest of their portfolio is helping or hindering their impact goals.

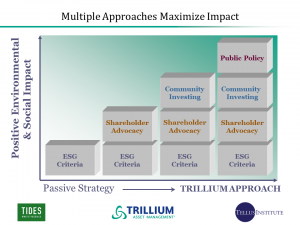

- ESG/SRI criteria, shareholder advocacy and public policy advocacy are also tools to influence the impact of investments. The accompanying chart illustrates how Trillium uses these tools to maximize impact.

Impact investing complements the emergence of alternative models for business organizations.

- Equal Exchange, represented on the panel by Daniel Fireside, is just one example.

- Organized as a cooperative, it has impact investors who own non-voting shares.

- Investors receive a fixed (5%) dividend when the company earns profits.

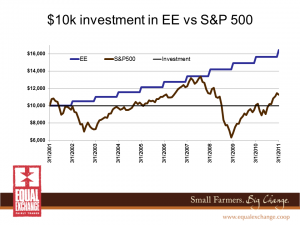

- Equal Exchange has been successful in achieving its goal of supporting small-scale farmers while earning a return. Over the 10 years from 2001-11, shareholders outperformed the S&P 500 with significantly less volatility.

- Closely engaging their investors in their business is a key to success in attracting and retaining investors and capital.

- Impact investments can be designed to support organizational structures like cooperatives, B-corporations, social benefit corporations and others.

For additional information:

- GIIN – the Global Impact Investing Network

- White paper on Total Porfolio Activation from Trillium Asset Management

- Equal Exchange cooperative